Expanded Child Tax Credit 2024 Update Form – Changes in legislation expanded the spectrum of families that can access credit with the 2023 tax year, filed in 2024, families with no income can also apply to the CTC and get a refund of up to . As the 2024 tax season approaches, families with children may find a pleasant surprise in the form of additional child tax credit payments. Beyond the federal allowance of up to $2,000 per child, .

Expanded Child Tax Credit 2024 Update Form

Source : kansasreflector.com

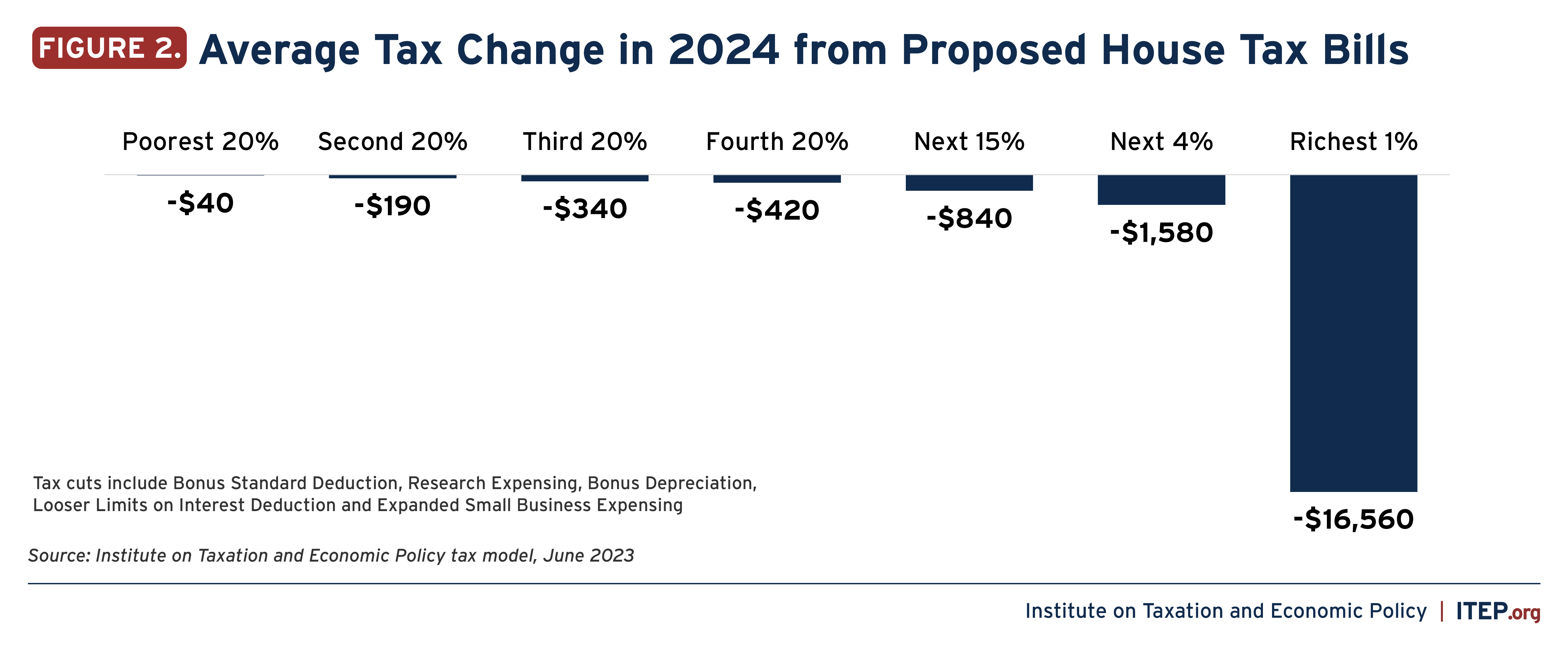

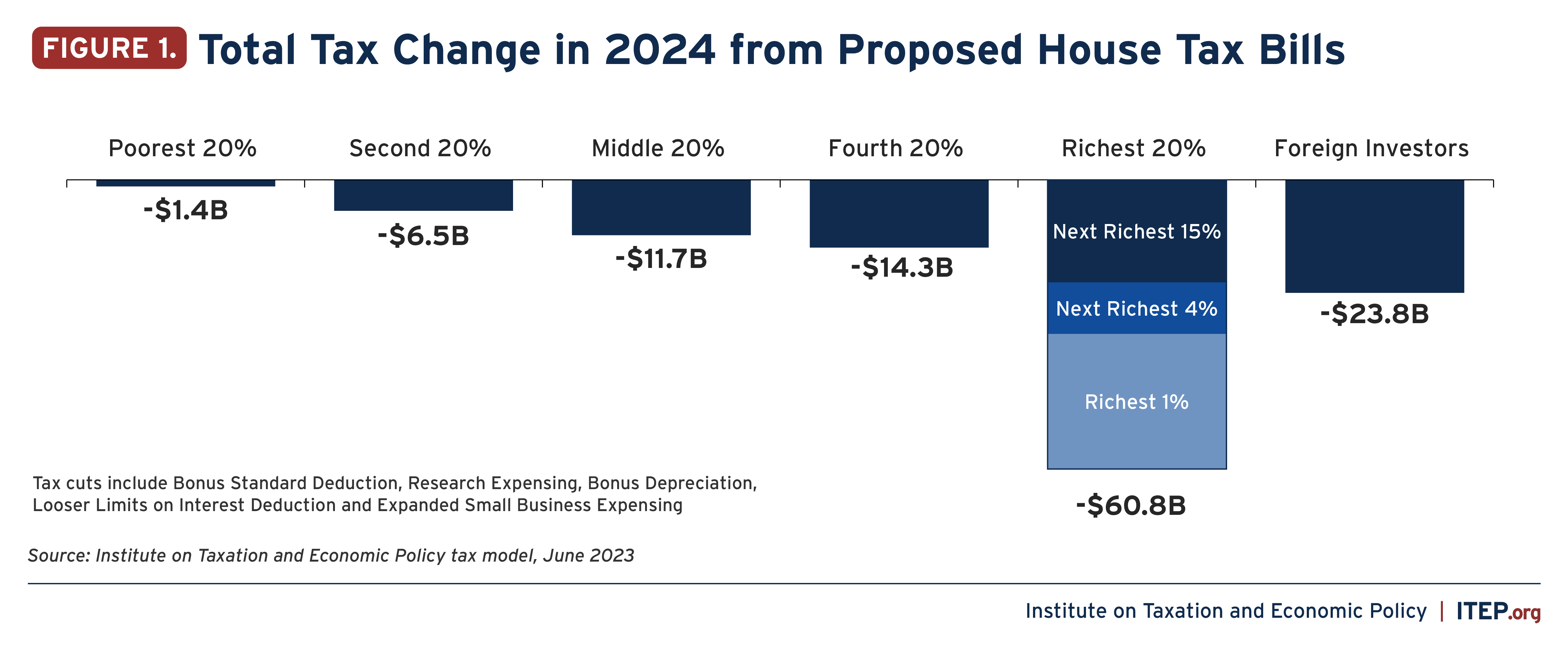

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Child tax credit expansion, business incentives combined in new

Source : nebraskaexaminer.com

2023 2024 Child Tax Credit: What Will You Receive? | SmartAsset

Source : smartasset.com

Child tax credit expansion, business incentives combined in new

Source : iowacapitaldispatch.com

Child Tax Credit Definition: How It Works and How to Claim It

Source : www.investopedia.com

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

Child tax credit expansion, business incentives combined in new

Source : minnesotareformer.com

Child tax credit expansion, business incentives combined in new

Source : missouriindependent.com

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While

Source : itep.org

Expanded Child Tax Credit 2024 Update Form Child tax credit expansion, business incentives combined in new : including the age of the child, their relationship with the claimant, and their income, to qualify. To be eligible for the credit, the taxpayer must submit a federal tax return (Form 1040 or 1040-SR) . Sen. Bill Cassidy is advocating for a change to the $600 IRS reporting requirement be included in the child tax credit and business tax bill. .

:max_bytes(150000):strip_icc()/child-tax-credit-4199453-1-7dd01914195e4ab2bc05ae78a40f8f0c.jpg)